October 29, 2020

Trump and Biden Tax Plan Comparison

Election Day is November 3rd! Do you know about the Biden and Trump tax plans?

Pop culture icons are even weighing in on Biden’s and Trump’s tax plans. The rapper 50 Cent has said he supports the Trump tax plan because he “doesn’t want to be 20 Cent.” Whereas, Dwayne “The Rock” Johnson is supporting Biden’s platform. In any event, taxpayers need to be informed to plan and prepare for each tax proposal.

Current Tax Structure and Trump’s Additional Proposals

Tax Cuts and Jobs Act (TCJA) that President Trump enacted in December 2017 reduced tax rates for individuals, businesses, and estates. Corporate tax rates were reduced from 35% to 21%, and the top individual tax rate slightly decreased from 39.6% to 37%. These cuts are set to expire by 2026.

The Trump plan is to extend the provisions of the TCJA beyond their scheduled expiration and maintain the top rate at 37% for top earners and the 20% deduction for pass-through owners.

Under Trump’s plan, the TCJA will retain the $11.58 million per person and $23.16 million per couple estate-tax exemption without incurring estate tax. The step-up in cost basis at death would be maintained.

The executive order issued on August 8, 2020, by President Trump offered additional relief to working taxpayers. This order gave employees the choice to defer the payment of 6.2% employee portion of Social Security taxes to 2021. Trump’s tax proposal is to forgive the tax entirely rather than deferring the payment.

Biden’s Tax Plan for Individuals

Democratic presidential candidate Joe Biden is proposing many significant changes of his own to the tax code.

Individuals with income over $400,000 would be most affected as the top individual tax rate would revert back to the pre-TCJA rate of 39.6% along with an additional Social Security tax. Social Security payroll taxes are currently capped at $137,700. This proposal creates an additional Social Security Tax of 12.4% evenly split between employees and employers for wages over $400,000. Wages between $137,000 and $400,000 would not be taxed at this new rate.

Restoration of the Pease limitation on itemized deductions for those with income above $400,000. The itemized deductions for these earners would be limited to 28% of income, and capital gains rates would increase from 20% to 39.6%. A phase-out of Section 199A deduction is also included for high earners; the top effective rate on pass-through entities is currently 29.6%. For taxpayers earning more than $1 million, the capital gains tax would increase to 43.4 percent from the current top rate of 23.8 percent.

Section 1031 like-kind exchanges for real property and bonus depreciation will be eliminated. The rules of the like-kind exchanges help a property investor to avoid capital gains taxes on sales if the proceeds are invested in another piece of real property.

Other special individual tax incentives of the Biden plan include student loan forgiveness and renewable energy-related tax credits. First-Time Homebuyers’ Tax Credit would be renewed, providing up to $15,000 for first-time homebuyers. There would also be the introduction of a new 26 percent tax credit to match traditional retirement contributions. This would be as a replacement for the deductibility of those contributions.

The Child and Dependent Care Tax Credit (CDCTC) maximum increases from $3,000 to $8,000, and the Child Care Credit (CTC) would rise from $2,000 to $3,000 for children 17 or younger, with a $600 bonus credit for children under 6.

Other tax considerations include a credit to reduce rent and utilities to 30 percent of income, expand Earned Income Tax Credit (EITC) for those older than 65, a $5,000 tax credit for informal caregivers, and expand the Low-Income Housing Tax Credit (LIHTC).

Biden’s Tax Plan for Businesses

The Biden plan increases corporate tax rates from 21% to 28%. Biden’s plan does propose retaining the TCJA’s revenue raisers, particularly the use of net operating losses (NOLs), limitations on business interest deductions, and amortizing research and development expenses. Additionally, this plan wants to impose a 15 percent minimum tax on large businesses with $100 million or more in income. There is also a doubling of the tax on foreign subsidiary international profits to 21 percent from 10.5 percent.

The Biden plan would make the New Markets Tax Credit permanent in distressed communities. The hope of offering these credits to small businesses is to encourage workplace retirement savings accounts and adopt renewable-energy alternatives.

The Tax Foundation has evaluated Biden’s corporate and individual tax plans. According to the International Tax Competitiveness Index, the United States currently has the 19th most competitive corporate tax rates among other nations. Biden’s plan, if implemented, would push the US corporate ranking to 33rd position. The non-profit surmised that individual taxpayers in California, New York, and New Jersey would experience a considerable tax hike. Consequently, the U.S. tax competitiveness rank for individual tax rates would fall from 23rd to 36th, last for individual taxation.

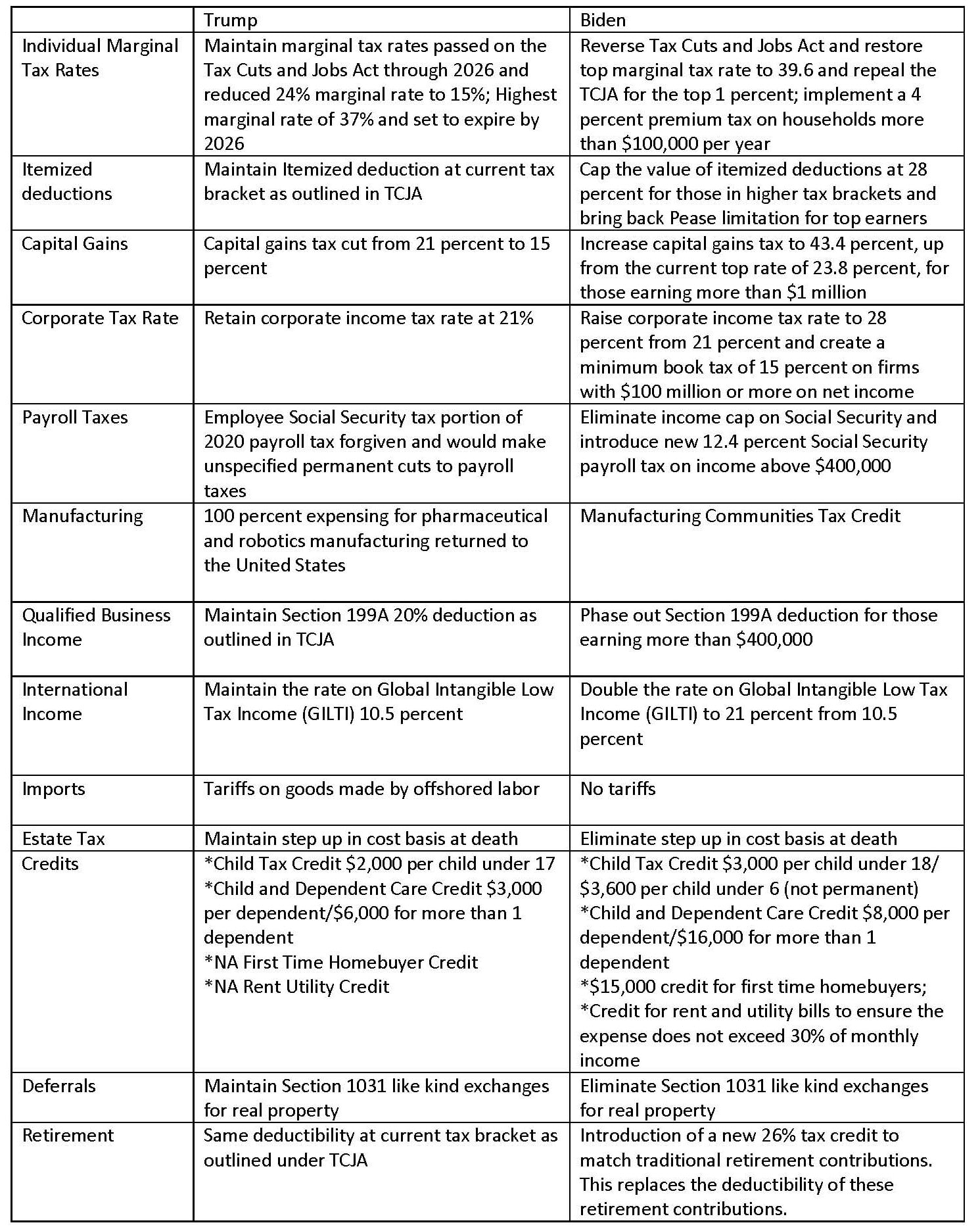

Comparison of Biden and Trump Tax Plans

Stay tuned for year-end planning suggestions to help you be in the best position in the fourth quarter of 2020.

Maria is a partner at Wilke & Associates servicing closely-held businesses in manufacturing, real estate, transportation/logistics, and technology industries as well as high net worth individuals and executives in delivering effective tax strategies.