June 30, 2020

Pennsylvania Small Business Grants

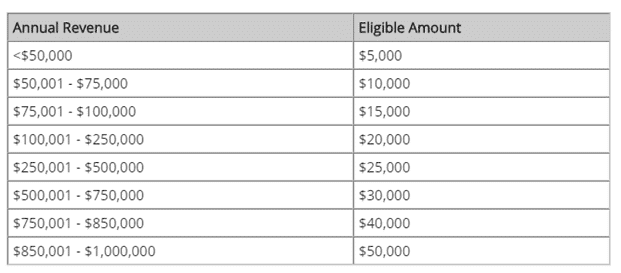

PA Statewide Small Business Assistance program will provide grants ranging from $5,000 to $50,000

The COVID-19 Relief PA Statewide Small Business Assistance program is open for application and will provide grants ranging from $5,000 to $50,000 to small businesses economically impacted by COVID-19. This program is not a first-come, first-served program, but will fund the most qualified applicants. The funding provided by the Federal CARES Act was designated by the PA DCED and will be administered by the PA CDFI Network.

This program is designed to assist PA’s smallest businesses limiting applications to entities with:

1. $1 million or less in annual revenue — based on your most recently submitted tax return- 2018 or 2019

2. 25 or fewer full-time equivalent employees

3. Businesses established by 2/15/2020, physically located in PA and must generate at least 51% of their revenues in PA

Applications will be accepted in a series of application windows, the first being, June 30 through July 14th. You will need to apply through a PA Community Development Financial Institution (CDFI).

The grant funds may be used for payroll, rent or mortgage interest, utilities, health insurance, and/or COVID related expenses.

The three CDFIs servicing Allegheny County are:

Bridgeway Capital – https://www.bridgewaycapital.org/

The Progress Fund – https://www.progressfund.org/contact-us/

Northside Community Development Fund – https://www.nscdfund.org/

The documentation necessary to apply includes:

- Most recently filed tax return

- Proof of tax payment

- DBA or FBN certificate and proof of ownership

- Business License

- Government Issued ID

Please reference the Fact Sheet published by the PA DCED.

Do not be discouraged by the priority of small businesses that is stated in the Purpose section of the fact sheet, there is significant funding available!

Your business may have experienced financial fluctuations in the last 6 months, and you are trying to decipher how new standards and legislation affect your business. Now is the time to consider leaning on your accountant for cash flow guidance, tax deadlines, completing loan applications, tax credit calculations, and interpreting legislation. Our accountants are available, and we have the knowledge, skill, and information that you need right now to address your financial needs in a timely fashion adequately. Contact us today.

Nichole is a General Ledger and Tax Manager for Wilke & Associates CPAs & Business Advisors. Her areas of expertise include tax planning & preparation, software training & implementation, and CFO/Controller services.