March 10, 2022

HSA Overview

HSAs provide many benefits to individuals who want to save money on taxes and healthcare costs. You can fund your HSA with pre-tax dollars and watch your investments grow tax-free. Then, you can use this tax-free money to pay for qualified medical expenses. This triple tax advantage makes it easier to save money on healthcare costs.

With an HSA, you don’t have to worry about spending the money in your HSA every year. Unlike a flexible spending account (FSA), your funds can carry over from year to year if you don’t spend them. The FSA’s popular “use-it-or-lose-it” feature does not apply to HSAs.

You can invest any unused dollars in the market until you’re ready to use them. By investing in assets that can grow over time, you increase the amount of money in your HSA. The best part is that your money has a chance to grow tax-free.

You do not pay taxes on HSA withdrawals that cover qualified medical expenses. If you use funds on ineligible expenses, you may incur a withdrawal penalty. It all depends on your age.

If you’re 65 or over, the HSA provides you with more flexibility. You won’t pay a penalty if you use your HSA money to pay for a non-qualified expense. You are free to use your HSA funds however you want. However, the distribution will be classified as income, and subject to pay income taxes on the distribution.

Individuals under age 65 have to be careful when withdrawing money from an HSA. You may be subject to a 20% tax penalty if you use HSA funds to pay for nonmedical expenses. You will also have to pay ordinary income tax on the distribution.

WHO CAN BENEFIT THE MOST FROM HSA?

High Deductible Health Plans (HDHP) and HSAs often make the most sense for people who are relatively healthy with minimal expectations for annual healthcare costs. HDHPs usually offer lower premiums for the tradeoff of higher deductibles that would need to be paid if an emergency arises. This is what makes the combination of an HDHP and HSA very beneficial. Plan owners can potentially save indefinitely through an HSA for any emergencies that may require a high deductible payment.

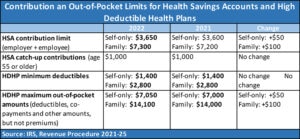

HSAs and HDHPs can also appeal to high-income earners as well as individuals nearing the age of 65. High-income earners choosing an HDHP can potentially use HSAs to save up to $8,300 per year in a tax-sheltered account. For both high-income earners and those approaching retirement, the HSA can be a worthwhile vehicle for building a medical emergency fund while also saving in a type of alternative retirement vehicle.

Conversely, be aware that if you incur substantial health costs for standard medical care, the high-deductible health plan required to open an HSA might not be the right choice for you. Even though you will pay less in premiums with the HDHP, it could be difficult even with money in an HSA to come up with the cash to meet the deductible for a costly medical procedure.

CRITERIA FOR HSA

According to federal guidelines, you can open and contribute to an HSA if you:

• Are covered under a qualifying high-deductible health plan which meets the minimum deductible and the maximum out of pocket threshold for the year

• Are not covered by any other medical plan, such as that for a spouse

• Are at least 18 years old

• Are not enrolled in Medicare

• Are not enrolled in TRICARE or TRICARE for Life

• Are not claimed as a dependent on someone else’s tax return

• Are not covered by medical benefits from the Veterans Administration

• Do not have any disqualifying alternative medical savings accounts, like a Flexible Spending Account or Health Reimbursement Account

CONTRIBUTIONS

If your employer offers HSAs, you can contribute pre-tax dollars to fund your HSA.

If you are self-employed, you can set up contributions from your bank account to an HSA. Since you are funding the account with after-tax dollars, you’ll be able to claim a tax deduction when you file taxes. This will reduce the amount of money that you pay taxes on at the end of the year.

Contributions to an HSA can be made up until tax filing day of the following year. The 2021 HSA contribution deadline is April 15, 2022. You can only make contributions for the months you were eligible to contribute.

HEALTH PLAN (HIGH DEDUCTIBLE)

For 2022, a health plan is generally considered compatible with an HSA if the annual deductible is at least $1,400 for individual coverage and $2,800 for family coverage. Additionally, Out-of-pocket costs, to include deductibles and copayments, but not premiums, are limited to $7,000 for an individual and $14,000 for a family.

WHAT CAN BE COVERED BY HSA FUNDS?

You can use HSA funds to pay for your qualified out-of-pocket medical expenses. This includes copayments and deductibles. Your HSA can fund common items like prescription medicines and asthma inhalers. HSA dollars can also cover eligible expenses for your spouse and dependents. There are a few expenses, like gym memberships and cosmetic surgery copayments, that won’t qualify. HSA funds do not cover the health insurance premiums for the qualifying plan.

If you’re not sure what expenses count, the IRS offers a list of eligible medical expenses.

Amy Labosco, SHRM-CP

Amy is the Human Resources Manager at Wilke & Associates, supporting the Firm and clients with all types of HR needs, including Recruiting and Staffing, Employee Benefits, and Human Resource Compliance.