May 19, 2021

ASC-2016-02 Leases

ASU 2016-02 is effective for nonpublic entities for the calendar year 2022. The effective date was changed from the calendar year 2021 as a result of COVID-19.

Early adoption of the new standard is permitted for all entities. All companies with lease agreements will be affected. Industries that could be significantly impacted include those with multiple locations (retail operations) and a significant investment in property, plant, and equipment (transportation companies).

A lease is defined as a “contract, or part of a contract, that conveys the right to control the use of identified property, plant, or equipment (an identified asset) for a period of time in exchange for consideration.” The customer controls an identified asset when the customer has the right to obtain substantially all of the economic benefits from its use and has the right to direct its use.

As of the lease commencement date, the lessee recognizes the following:

- Liability for its lease obligation (initially measured at the present value of future lease payments).

- Asset for its right to use the underlying asset (ROU asset) which is equal to the lease liability adjusted for lease payments made at or before lease commencement, lease incentives, and any initial direct costs.

Leases may be classified as either an operating lease or a finance lease. The lease would be classified as a finance lease if any of the following criteria are met:

- Lease transfers ownership to lessee by the end of the lease term.

- Bargain purchase option which the lessee is reasonably certain to exercise.

- Lease term is for a major part of the remaining economic life of the underlying asset.

- Present value of the sum of lease payments and any guaranteed residual value equals or exceeds substantially all of the fair value of the underlying asset.

- Underlying asset is of such a specialized nature it is expected to have no alternative use to the lessor at the end of the lease term.

Short-term lease payments may be expensed as incurred. A lessee can elect (by asset class) not to record lease assets and liabilities on the balance sheet if the term of the lease is 12 months or less and the lease does not include a purchase option that the lessee is reasonably certain to exercise. Renewal options which the lessee is reasonably certain to exercise must be included in determining if the short-term lease exception is permissible.

Lessees and lessors are required to account for related-party leasing arrangements on the basis of the legally enforceable terms and conditions of the lease rather than the substance of the arrangement. This is a significant change from current U.S. GAAP, under which a lessee and lessor would consider the substance of the contract as well as its legal form.

Example:

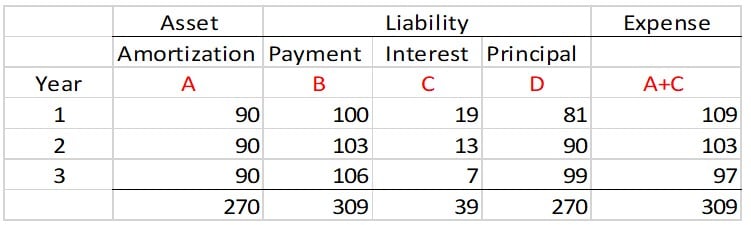

Lease term 3 years (no renewal option)

Economic life 5 years

No purchase option

Rent payments $100, paid in arrears, escalating $3 annually

Interest rate of 7%

Fair value of the asset = $500

Present value of lease payments = $270

Operating Lease

Initial recognition entry

Debit – Right-of-use asset for $270

Credit – Lease liability for $270

Year 1 Entry to record the lease payment and expense

Debit – Lease expense for $103 A

Debit – Lease liability for $81 D

Credit – Cash for $100 B

Credit – Accumulated amortization for $84 A-C

Finance Lease

Initial recognition entry

Debit – Right-of-use asset for $270

Credit – Lease liability for $270

Year 1 Entry to record the lease payment and expense

Debit – Interest expense for $19 C

Debit – Amortization expense for $90 A

Debit – Lease liability for $81 D

Credit – Cash for $100 B

Credit – Accumulated amortization for $90 A

Required Disclosures:

- Nature of its leases

- Information about leases that have not yet commenced

- Related-party lease transactions

- Accounting policy election regarding short-term leases

- Finance and operating lease costs

- Short-term and variable lease costs

- Sublease income

- Gain or loss from sale and leaseback transactions

- Maturity analysis for lease obligations

- Weighted-average remaining lease term

- Weighted-average discount rate

Tax Impact

The new lease standard only affects GAAP presentation of financial statements; it has no bearing on the calculation of income taxes. For income tax purposes, rent can only be deducted for the amount paid during the year, or that applies to the use of the rented property during the tax year (Pub 535). This means that a maximum of 12 months of rent payments can be included as a deduction on the business income tax return. Any difference in rent expense between the tax return and the financial statements, due to the implementation of the lease standard, would be presented on Schedule M1 as an adjustment.

Your business may have experienced financial fluctuations, and you are trying to decipher how new standards and legislation affect your business. Now is the time to consider leaning on your accountant for cash flow guidance, tax deadlines, completing loan applications, tax credit calculations, and interpreting legislation. Our accountants are available, and we have the knowledge, skill, and information that you need right now to adequately address your financial needs in a timely fashion.

Amy is a manager with over 20 years of audit experience in various industries; including public companies, non-profits, manufacturing, distribution, construction, government, oil and gas, pension plans, and transportation.